The exterior fund manager backed by Berkshire Hathaway’s Charlie Munger, Li Lu, helps make no bones about it when he claims ‘The most significant expenditure possibility is not the volatility of charges, but no matter whether you will put up with a permanent reduction of cash.’ When we think about how risky a organization is, we usually like to seem at its use of credit card debt, because financial debt overload can guide to wreck. Importantly, Gruma, S.A.B. de C.V. (BMV:GRUMAB) does have credit card debt. But the real problem is irrespective of whether this financial debt is earning the enterprise dangerous.

When Is Debt Hazardous?

Commonly speaking, debt only turns into a serious challenge when a enterprise can not conveniently pay back it off, either by boosting capital or with its have income movement. Part and parcel of capitalism is the process of ‘creative destruction’ in which failed corporations are mercilessly liquidated by their bankers. On the other hand, a additional common (but continue to highly-priced) situation is where by a corporation must dilute shareholders at a low-priced share cost merely to get financial debt underneath regulate. Of program, a good deal of organizations use debt to fund expansion, without having any negative consequences. When we examine debt stages, we first contemplate each hard cash and financial debt concentrations, alongside one another.

Perspective our newest analysis for Gruma. de

How Significantly Personal debt Does Gruma. de Carry?

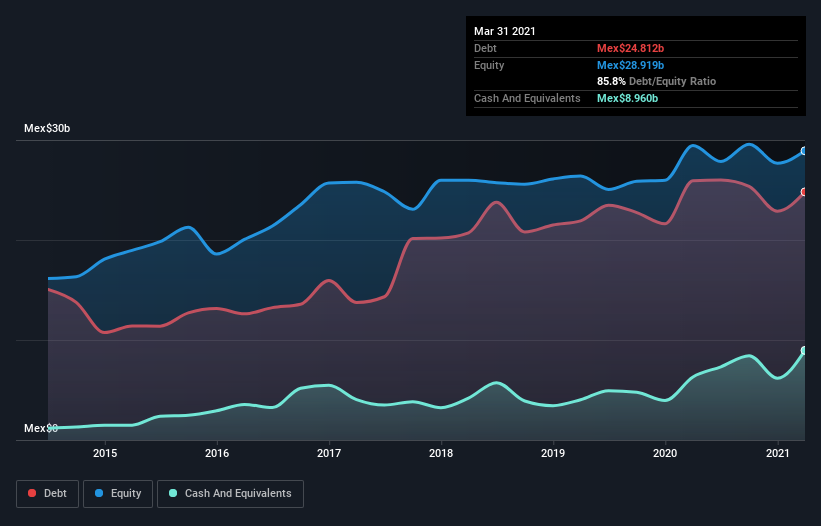

You can simply click the graphic underneath for the historical numbers, but it shows that Gruma. de experienced Mex$24.8b of debt in March 2021, down from Mex$25.9b, a person calendar year right before. Even so, for the reason that it has a funds reserve of Mex$8.96b, its internet debt is significantly less, at about Mex$15.9b.

A Look At Gruma. de’s Liabilities

According to the last reported stability sheet, Gruma. de had liabilities of Mex$16.3b thanks inside 12 months, and liabilities of Mex$31.2b because of over and above 12 months. Offsetting this, it experienced Mex$8.96b in funds and Mex$10.7b in receivables that have been thanks in 12 months. So it has liabilities totalling Mex$27.8b extra than its money and close to-expression receivables, put together.

Gruma. de has a marketplace capitalization of Mex$89.4b, so it could quite possible raise dollars to ameliorate its balance sheet, if the need arose. Having said that, it is continue to worthwhile using a near look at its capability to spend off credit card debt.

We evaluate a firm’s personal debt load relative to its earnings energy by wanting at its net credit card debt divided by its earnings in advance of interest, tax, depreciation, and amortization (EBITDA) and by calculating how effortlessly its earnings in advance of curiosity and tax (EBIT) address its interest cost (interest deal with). The gain of this technique is that we consider into account each the absolute quantum of financial debt (with internet financial debt to EBITDA) and the true interest bills linked with that credit card debt (with its desire deal with ratio).

While Gruma. de’s minimal financial debt to EBITDA ratio of 1.2 indicates only modest use of credit card debt, the fact that EBIT only lined the curiosity price by 7. instances previous yr does give us pause. But the interest payments are definitely enough to have us imagining about how inexpensive its financial debt is. And we also notice warmly that Gruma. de grew its EBIT by 13% past calendar year, building its financial debt load less complicated to take care of. There is certainly no question that we learn most about debt from the balance sheet. But it is future earnings, additional than anything, that will ascertain Gruma. de’s means to sustain a healthy balance sheet going ahead. So if you’re focused on the long run you can check out out this free of charge report showing analyst gain forecasts.

Last but not least, a small business needs totally free funds movement to spend off financial debt accounting profits just don’t minimize it. So we plainly will need to glance at no matter whether that EBIT is primary to corresponding cost-free dollars move. In excess of the most current three years, Gruma. de recorded free of charge income move worth 69% of its EBIT, which is all-around usual, presented absolutely free income movement excludes desire and tax. This cold tricky cash suggests it can lessen its personal debt when it wishes to.

Our Perspective

Happily, Gruma. de’s amazing conversion of EBIT to cost-free money stream indicates it has the upper hand on its debt. And we also imagined its internet personal debt to EBITDA was a good. Seeking at all the aforementioned variables with each other, it strikes us that Gruma. de can take care of its personal debt pretty comfortably. On the moreover side, this leverage can increase shareholder returns, but the likely draw back is additional chance of reduction, so it can be worthy of monitoring the balance sheet. There is certainly no doubt that we study most about personal debt from the balance sheet. However, not all expense risk resides inside the harmony sheet – much from it. Case in stage: We’ve spotted 2 warning indicators for Gruma. de you need to be conscious of.

If, soon after all that, you might be much more interested in a quickly developing company with a rock-stable equilibrium sheet, then verify out our record of net dollars development stocks devoid of hold off.

Promoted

If you make a decision to trade Gruma. de, use the most affordable-value* system that is rated #1 In general by Barron’s, Interactive Brokers. Trade shares, solutions, futures, foreign exchange, bonds and resources on 135 markets, all from a one built-in account.

This post by Basically Wall St is typical in nature. It does not constitute a suggestion to obtain or offer any stock, and does not acquire account of your aims, or your economical circumstance. We aim to carry you lengthy-phrase concentrated investigation driven by essential data. Observe that our investigation could not aspect in the latest cost-delicate corporation bulletins or qualitative material. Just Wall St has no position in any shares outlined.

*Interactive Brokers Rated Lowest Expense Broker by StockBrokers.com Once-a-year On the internet Review 2020

Have opinions on this short article? Involved about the articles? Get in touch with us straight. Alternatively, e-mail editorial-group (at) simplywallst.com.

More Stories

5 Gourmet Hacked Cheap And Fast Meals

The Health Benefits Of Chicken Curry Recipes

Guide To Deep Fryers